‘Devil in the details’: Senators urge government to axe tax act changes

Ottawa – The federal government should scrap or at least delay plans to amend the Income Tax Act as the proposals risk harming the Canadians these changes are meant to help, the Senate Committee on National Finance said in a report released Wednesday.

The committee’s report is the product of extensive study and cross-Canada consultations with the people who have the most to lose under the proposed changes. This work took place with the endorsement of the federal finance minister.

The majority of senators on the committee believe cancellation is the most prudent course of action. However, committee Deputy Chair Senator André Pratte and Senator Éric Forest disagreed.

As an alternative to cancellation, delaying fiscal reform implementation would also give the government more time to consult with businesses and tax specialists on the details of the changes, once these have been released.

Witnesses described in concrete terms the extent to which some changes would be harmful to them. Proposed restrictions on passive investments, for instance, would discourage business owners from saving for capital investments, economic downturns or even parental leave and retirement.

There is another reason for the government to withdraw or delay its proposals.

Over the past decades, various governments have made incremental changes to the tax system, which has become bloated, complex and cumbersome. The last comprehensive review of the tax system took place in the 1960s; the committee believes it is long past time for the government to take a close look at our existing system.

If the government truly wishes to make meaningful, lasting changes toward a fairer tax system — and maintain Canada’s competitiveness with other countries that have simplified their own tax codes — the committee believes the government must embark on a full review of the tax system.

It would be an ambitious, time-consuming and difficult project. But, done well and with input from Canadians, it would leave a lasting legacy of stability and profitability.

The committee urges the government to embrace this challenge.

Quick Facts

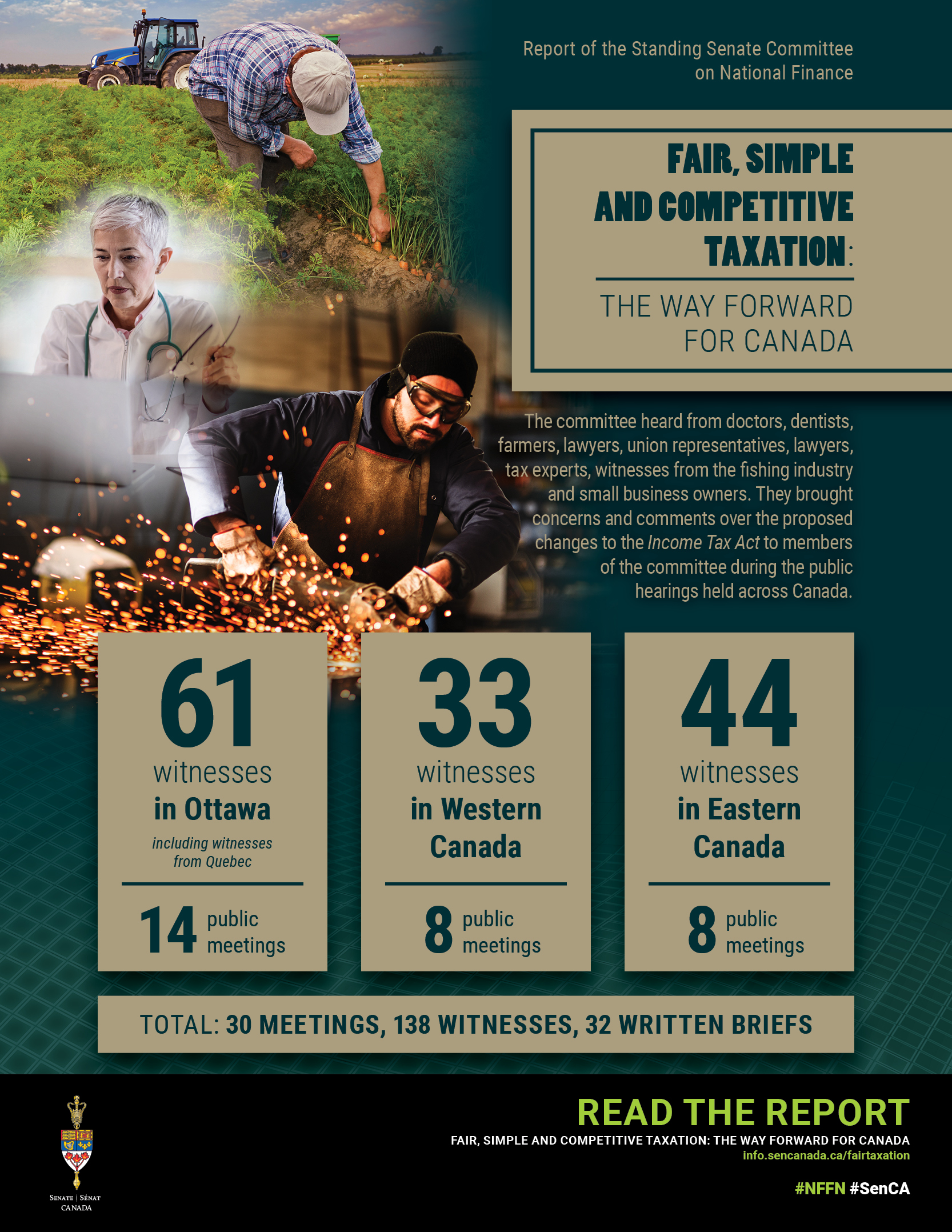

- Senators held 30 public meetings across Canada during the committee’s study and heard from 138 witnesses. The committee also received 32 written briefs.

- Witnesses came from many sectors including financial services, healthcare, agriculture, academia, government, small business and labour groups.

- The federal government has yet to reveal crucial details of some aspects of its planned reforms; some proposed rules have only been outlined in press releases. As one witness noted, the devil is in the details.

Quotes

“Canadians expect a tax system that is fair and equitable. Making sudden changes to the Income Tax Act — in some cases without providing the detail necessary to understand their implications — does not inspire confidence. If the government wishes to implement tax reform it must do so carefully, cautiously and with consideration for how it will affect Canadians.”

- Senator Percy Mockler, Chair of the committee

“The federal government has prided itself on supporting women but the proposed tax changes risk harming them. Businesswomen could be financially penalized for saving for maternity leave and spouses who contribute to their partner’s business in valuable but informal ways would see a reduced financial benefit. A more detailed and public gender analysis is needed.”

- Senator Mobina S. B. Jaffer, Deputy Chair of the committee

“In this sometimes fractious debate about fiscal reform, everyone agreed on one thing: a thorough review of the overly complex Income Tax Act has been long overdue.”

- Senator Anne Cools, committee member

Associated Links

- Read the report, Fair, Simple and Competitive Taxation: The way forward for Canada

- Follow the committee on social media using the hashtag #NFFN.

- Sign up for the Senate’s eNewsletter.

For more information, please contact:

Sonia Noreau

Public Relations Officer

Communications Directorate | Senate of Canada

613-614-1180 sonia.noreau@sen.parl.gc.ca

Senators Percy Mockler (committee chair), Anne Cools and Elizabeth Marshall share findings of the Senate Committee on National Finance’s report at a press conference in Ottawa on Wednesday, December 13, 2017.